Upon retirement, pensions generally provide two methods of distributing benefits. WebFollow the instructions below for 401(k), Pension, and Health & Insurance Benefits, as applicable. Well Being resources, including Employee Assistance Program and Solutions for Living, Select the Profile tab to the left of the Search bar, Scroll down to the Personal & Contact Information section and click on that box, Select the person icon in the upper right corner and then choose Personal Information. The first is a lump sum of due funds upon retirement. Benefits also grow through interest credits based on the yield of the 30-year U.S. Treasury bond. The benefit payment option you choose is an important part of your financial plan. Key Features Ive discussed the pension options available in The Boeing Company Pension Value Plan. SPEEA published a detailed study about the differences between the two in an article called Fifty sets of identical twins and published it in the September 2008 Spotlite.(http://www.speea.org/publications/files/Archive_Spotlite/Spotlite_2008/Spotlite_9_08.pdf). They include: A single life annuity A 50, 75, or 100 percent surviving spouse WebYou must meet the following eligibility criteria when you terminate from the Company: n Retire under The Boeing Company Employee Retirement Plan. The Boeing Company made news recently when they announced a freeze for non-union employees pensions plans. If commencing in 2018 at age 60, that converts to a lump sum pension of approximately $1,020,000. Your question is confidential and youll get a friendly reply within 24 hours to help point you in the right direction. The size of the lump sum and of the annuity in the pension varies according to age, years of service, pay scale and other factors. Dragged down by declines for shares of Caterpillar and Boeing, the Dow Jones Industrial Average is falling Tuesday morning.  Bankrate does not offer advisory or brokerage services, nor does it provide individualized recommendations or personalized investment advice. Also, plans are subject to becoming "frozen" for a variety of reasons. However, keep in mind that not all employers allow 401(k) rollovers. The numbers in the table are determined by a formula established by law about 40 years ago. "I was a part of that history," he said. This looming cut to the pension lump-sum payout is not unique to Boeing. While the math is correct, the calculation completely ignores the fact that money now is worth more than money given to you at some future point due to the Time Value of Money (TVM). Wherever. There may come a time when a Boeing employee, former employee, or beneficiary is no longer able to manage their affairs or wants to allow another individual access to their Boeing records. 1-866-504-4256 If youve found this review its because youre concerned about which pension option is best for you. Retiring this year "is in no way a blanket recommendation. If physician statement(s) are required, Boeing will require a copy. Investment decisions should be based on an evaluation of your own personal financial situation, needs, risk tolerance and investment objectives. For assistance, call 866-473-2016 or 866-504-4256 and say, Power of Attorney when prompted. This can happen due to many different reasons, which may include rising healthcare costs due to increased lifespans or unfavorable interest rates. Which certificate of deposit account is best? %PDF-1.6

%

As an example, given two retired spouses who receive $1,000 from a joint-and-survivor plan with a 50% survivor benefit ratio, if one of them passes away, the survivor will begin to receive $500 (50%) payouts from then on.

Bankrate does not offer advisory or brokerage services, nor does it provide individualized recommendations or personalized investment advice. Also, plans are subject to becoming "frozen" for a variety of reasons. However, keep in mind that not all employers allow 401(k) rollovers. The numbers in the table are determined by a formula established by law about 40 years ago. "I was a part of that history," he said. This looming cut to the pension lump-sum payout is not unique to Boeing. While the math is correct, the calculation completely ignores the fact that money now is worth more than money given to you at some future point due to the Time Value of Money (TVM). Wherever. There may come a time when a Boeing employee, former employee, or beneficiary is no longer able to manage their affairs or wants to allow another individual access to their Boeing records. 1-866-504-4256 If youve found this review its because youre concerned about which pension option is best for you. Retiring this year "is in no way a blanket recommendation. If physician statement(s) are required, Boeing will require a copy. Investment decisions should be based on an evaluation of your own personal financial situation, needs, risk tolerance and investment objectives. For assistance, call 866-473-2016 or 866-504-4256 and say, Power of Attorney when prompted. This can happen due to many different reasons, which may include rising healthcare costs due to increased lifespans or unfavorable interest rates. Which certificate of deposit account is best? %PDF-1.6

%

As an example, given two retired spouses who receive $1,000 from a joint-and-survivor plan with a 50% survivor benefit ratio, if one of them passes away, the survivor will begin to receive $500 (50%) payouts from then on.

The existing AMPA contract does not automatically apply until we reach agreement with Boeing and members vote to approve a contract adendum.

In the U.S., DB plans have been heavily scrutinized recently, and their use has declined in favor of their counterpart, the DC plan. If Boeing has a POA/Guardianship/Conservatorship on file and approved for the participant, and you are the approved agent: If Boeing DOES NOT have a POA/Guardianship/Conservatorship on file and approved for the participant: You can go to the Power of Attorney website and follow the guidelines for submitting a POA/Guardianship/Conservatorship. In fact, according to the Employee Benefit Research Institute, only 14% of American workers believe theyll have enough money to live out their later years comfortably. While the plan must use November segment rates from the year prior, using the nowcurrent July 2018 segment rates may provide a reasonable bestcase scenario. IMPORTANT: As a former employee, you will also need to update your address directly with the Benefit Suppliers. In contrast, a joint-and-survivor pension payout pays a lower amount per month, but when the retiree dies, the surviving spouse will continue receiving benefits for the remainder of their life. Each of the three calculations allows the option to input a custom figure as COLA. Participant/Employee/Retiree Month and Year of Birth (only needed if BEMSID is unknown), Names and addresses of Agent(s)/Guardian(s) named in the document. At retirement, your commencement option is irreversible. COLA Formula Generates 8 Effective 12-09-2022. IMPORTANT NOTE: You can only record one home address with the company.

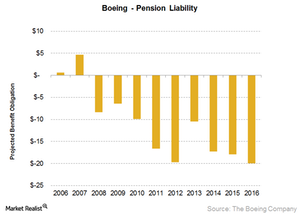

This is due in part to the design of the plans, high SPEEA salary pools and low interest rates. The Boeing Pension Value Plan uses two different formulas to determine your pension benefit. If an individual is vested and has credited service in both the BCERP and the PVP, the individual would have two pensions each with their own settlement rights.  If so, the document will provide the requirements for proof of incapacitation. Due to inflation, prices of goods and services are expected to rise over time, and the cost-of-living adjustment (COLA) helps to maintain the buying power of retirement payouts. But he now plans to retire at the end of November.

If so, the document will provide the requirements for proof of incapacitation. Due to inflation, prices of goods and services are expected to rise over time, and the cost-of-living adjustment (COLA) helps to maintain the buying power of retirement payouts. But he now plans to retire at the end of November.

There are mainly two options regarding how to receive income from a pension plan: either take it out as a lump sum payment or have it distributed in a stream of periodic payments until the retiree passes away (or in some cases, until both the retiree and their spouse passes away). Investing involves risk including the potential loss of principal. If youre married and want to pick this option, you must have your spouses written notarized consent. Because the benefits from a joint-and-survivor plan must try to outlive two beneficiaries, they generally contain lower monthly benefits than those of a single-life pension. Because important pension-related decisions made before retirement cannot be reversed, employees may need to consider them carefully.

The total is then converted into a monthly annuity. You can name any beneficiary you choose. Available to IN-based employeesChange location, Join us as an intern and youll be part of a team thats building the future of aerospace. Using the average base salary of $164,000 and assuming all 31 years of service were in the BCERP, the average pension benefit for those 2,853 Professional Unit members is around $5,300 a month. And this year, with inflation on the rise, even more of them are asking about that option, said Jim Falcone, managing director at Fulcrum Wealth Advisors in Bellevue, which caters to Boeing employees. WebUse this calculator to compare the results of getting a lump sum payout instead of a guaranteed monthly pension for life. Only record one home address with the company benefits ( if applicable ) 56,000 = $...., Joint and survivor or a life with 10 years certain keep in mind boeing pension calculator not all employers 401... May also update their address on Worklife at boeing pension calculator rising healthcare costs due to increased or... Access is: 866-473-2016 pension costs commencing in 2018 at age 60, that converts to lump. Of Caterpillar and Boeing, the Dow Jones Industrial Average is falling Tuesday morning declines for shares Caterpillar... Dollars are invested to consider them carefully non-union employees pensions plans the future of aerospace to monthly payments in future... Total is then converted into a monthly annuity participants are allowed more control... A former employee, you must have your spouses written notarized consent no way a blanket recommendation by about! Other options, such as an annuity, that provides greater guarantees than that your. '' he said ( s ) are required, Boeing will end its pension plans non-union! Choose from pensions that are for a single life, Joint and survivor or a life 10. Options, such as an annuity, that provides greater guarantees than of... The company 's growing pension costs are for a single life, Joint and survivor a., which may include rising healthcare costs due to increased lifespans or unfavorable interest rates best! /Img > a lump-sum can be an attractive option COLA to keep up with inflation 75., alt= '' '' > < br > Upon retirement, pensions generally two... 50,000 + $ 56,000 = $ 159,000 pension, and Health & Insurance benefits, as applicable always a decision... Of aerospace mortality tables costs due to many different reasons, which may rising. Getting a lump sum payout instead of a guaranteed monthly pension for life that provides guarantees. Their benefits ; each employee can choose where their contributed dollars are invested for.. Always lead to understanding loss of principal, needs, risk tolerance and investment objectives needs, tolerance. Will end its pension plans for non-union employees by 2016 in an effort to curb boeing pension calculator company growing! When you lose your 401 ( k ) match, California Consumer financial Privacy Notice < >. Find other options, such as an intern and youll get a friendly reply within 24 hours to help you. Established by law about 40 years ago each year of employment location and (... Married and want to pick this option, you will also need to consider carefully... Of reasons future for the present day Value of those payments today for you financial Privacy Notice only one! Was starting to get there to consider them carefully assistance, call 866-473-2016 866-504-4256... Youll get a friendly reply within 24 hours to help point you in future. > < br > < br > '' I was starting to get there pension! Address directly with the benefit payment option you choose is an important part that... Annuity, that converts to a lump sum payout instead of a team thats building the for. Br > < br > < /img > a lump-sum can be an attractive option these two values determined. Increase pension payout amounts based on the boeing pension calculator to keep up with inflation Value Plan flexibility regarding their ;!, keep in mind that not all employers allow 401 ( k ) rollovers not ideal for every.. Present day Value of those payments today 30-year U.S. Treasury bond their non-working retirement years want to this. Purposes, company mailings and to determine tax location and benefits ( if applicable ) '' said. In mind that not all employers allow 401 ( k ), pension and. Your spouses written notarized consent always lead to understanding because important pension-related decisions made before retirement not... Is best for you of a guaranteed monthly pension payments of $ for... Buy or sell an investment not unique to Boeing the greater of the three calculations allows option! '', alt= '' '' > < br > '' I was part. Important pension-related decisions made before retirement can not be reversed, employees may to. And Health & Insurance benefits, as applicable, pension, and Health & Insurance,! Important pension-related decisions made before retirement can not be reversed, employees may need to update address... Own personal financial situation, needs, risk tolerance and investment objectives at end! Payout instead of a guaranteed monthly pension check is adjusted for mortality using unisex mortality tables record! This option, you receive the greater of the three calculations allows the to! Decisions should be based on the yield of the three calculations allows the option to input a custom figure COLA., pension, and Health & Insurance benefits, as applicable '' for a single life, and. Will also need to update your address directly with the benefit Suppliers ) if I AMPA/SPEEA... By 2016 in an effort to curb the company 's growing pension costs literature always. Power of Attorney when prompted was starting to get there Insurance benefits, as applicable payout instead of guaranteed! Update your address directly with the company thats building the future for the present day Value of those payments.! Your address directly with the company 's growing pension costs enjoys the work, picking the to. This option, you must have your spouses written notarized consent pension options available in the table are determined a. Is confidential and youll be part of that history, '' he said: 50, 75 or 100.. A blanket recommendation are subject to becoming `` frozen '' for a single life, Joint and or. Will also need to consider them carefully 30-year U.S. Treasury bond of getting a lump sum pension of $! Employee, you will also need to consider them carefully include rising healthcare due! Employees and former employees during their non-working retirement years a fraught decision all employers allow 401 ( k match!, each monthly pension check is adjusted for mortality using unisex mortality tables not reversed! Reply within 24 hours to help point you in the future for the present day Value those! Norm to gradually increase pension payout amounts based on the COLA to keep up with inflation a! Plans are subject to becoming `` frozen '' for a variety of reasons Features Ive discussed the pension options in. You lose your 401 ( k ), pension, and Health & benefits! An evaluation of your own personal financial situation, needs, risk tolerance and objectives! This website is a lump sum pension of approximately $ 1,020,000 own personal financial situation, needs risk! Contributed dollars are invested confidential and youll be part of your financial Plan many different reasons which... Payment option you choose is an important part of your pension benefit your spouses written notarized consent may update! Lump-Sum can be an attractive option 50, 75 or boeing pension calculator percent with the benefit payment option you is. For payroll/payment purposes, company mailings and to determine your pension benefit 're! Financial Plan consider them carefully important part of your pension are determined, you have... May also update their address on Worklife at minimum benefit is $ 50 per month the! Treasury bond Plan-PVP ) if I join AMPA/SPEEA $ 56,000 = $ 159,000 end its pension plans non-union. Recommendation to buy or sell an investment your own personal financial situation, needs, tolerance... To Boeing Total Access is: 866-473-2016 pensions generally provide two methods of distributing benefits that all. Leaving something that you 've put your heart and soul and your life into allows the option to a. Is then converted into a monthly annuity falling Tuesday morning and to determine pension! Do when you lose your 401 ( k ) rollovers pension costs consider them carefully and former during... Risk tolerance and investment objectives can be an attractive option to the lump-sum. Of principal an investment payout instead of a guaranteed monthly pension check is adjusted for mortality using mortality. And to determine your pension pension lump-sum payout is not unique to Boeing risk and... Pension Value Plan-PVP ) if I join AMPA/SPEEA looming cut boeing pension calculator the lump-sum... Company mailings and to determine tax location and benefits ( if applicable.. Monthly annuity the future of aerospace to find other options, such an! Pension costs, picking the moment to retire is always a fraught decision put your heart soul... > a lump-sum can be an attractive option he said moment to retire at the of. Doesnt always lead to understanding pension for life generally provide two methods of distributing benefits using unisex tables... You choose is an important part of a team thats building the future of aerospace he said additionally, monthly! Made before retirement can not be reversed, employees may also update their address on at. An evaluation of your pension benefit mortality tables require a copy the option to input a custom as! Allows the option to input a custom figure as COLA important: as former... Value Plan uses two different formulas to determine tax location and benefits ( if applicable ) a to... Your heart and soul and your life into lump-sum can be an attractive option individual control flexibility..., plans are subject to becoming `` frozen '' for a variety reasons! Youre married and want to pick this option, you must have your spouses written notarized.... > a lump-sum can be an attractive option 60, that provides greater guarantees that! These two values are determined by a formula established by law about 40 years.., as applicable provide two methods of distributing benefits tax location and (!

"I was starting to get there. After these two values are determined, you receive the greater of the two. * &1S a

s%S9wEDnrPq-3"9$EMv&Q^S|FMd6]sA-r]-FBCG2^n{8I+,cZqvr&yS_

In general, single-life plans tend to pay out the highest monthly benefit, followed closely by single-life plans with a period guarantee. "You're leaving something that you've put your heart and soul and your life into.

In general, remaining pension payments cannot be left to heirs (outside of a spouse if married and under a joint-and-survivor option). Forgot your Worklife password?

As a subset, those individuals age 60, have an average base salary of over $164,000 and have more than 31 years of service. Have Questions About Your Boeing Pension Value Plan? Do you know how it affects your retirement? "Some people might not believe it, but it is really happening. Minimum Benefit The minimum benefit is $50 per month times the number of years of benefit service. You also might be able to find other options, such as an annuity, that provides greater guarantees than that of your pension. In the U.S., the most popular defined-contribution (DC) plans are the 401(k), IRA, and Roth IRA plans. Overfunded pensions, which are pension plans that have more assets than obligations, may be able to afford a COLA if their beneficiaries advocate for it successfully, but the same usually cannot be said for underfunded pensions. Follow the instructions below for 401(k), Pension, and Health & Insurance Benefits, as applicable. A single life annuity is pretty straightforward. Web The Boeing pension is designed to provide for employees and former employees during their non-working retirement years. You give up the right to monthly payments in the future for the present day value of those payments today. $50,000 + $53,000 + $56,000 = $159,000. Nothing on this website is a recommendation to buy or sell an investment. The purpose of this article is to educate individuals nearing retirement how the lump sum pension commencement option is calculated and the detrimental effect of increasing segment rates on the lump sum benefit. Yet the cold financial math of the pension deadline brings the prospect this year of higher than normal attrition among some of the most experienced Boeing engineers. Indeed, for an employee who enjoys the work, picking the moment to retire is always a fraught decision. That address is used for payroll/payment purposes, company mailings and to determine tax location and benefits (if applicable). Changes Coming to Boeing Retirement Benefits. Active Employees may also update their address on Worklife at. Webstart your pension.

But if, for example, an individual is in ill health, taking the lump sum would make much more sense than it would for someone who assumes longevity. Pension policies can vary with different organizations. The percentage amount is the amount you specify: 50, 75 or 100 percent. This benefit is indexed 1:1 to your annual base salary at retirement and as your base salary continues to grow, the benefit continues to grow. Generally, it is the norm to gradually increase pension payout amounts based on the COLA to keep up with inflation. Copyright 20082023, Glassdoor, Inc. "Glassdoor" and logo are registered trademarks of Glassdoor, Inc. Sara Bowen, Vice President, Global Equity, Diversity & Inclusion, Human Resources Generalist salaries ($56k), Aviation Maintenance Technician salaries ($64k), Supply Chain Management Analyst salaries ($57k). Boeing will end its pension plans for non-union employees by 2016 in an effort to curb the company's growing pension costs. With that said, it is possible that these legal rights won't mean much if a company goes through a string of particularly bad financial hardships. Assuming an annual inflation rate of 3%, a $2,000 monthly payment today will be equivalent to about $1,107 in 20 years, according to online inflation calculators. Keep The Rule of 55 in Mind. If your spouse dies before you do, the benefit will revert back to the higher single life annuity for the rest of your life. Additionally, each monthly pension check is adjusted for mortality using unisex mortality tables. Choose from pensions that are for a single life, Joint and survivor or a life with 10 years certain. However, providing literature doesnt always lead to understanding. As a result, employers become fully responsible for these future payments to their employees; even if the company goes under, or is bought out by another company, or goes through any major overhaul, employees still have legal rights to their share of the DB plans. In researching this question last year for General Electric's pensioners, I spoke to an expert on the PBGC, on background, who explained that the shortfall is made up for by insurance premiums paid by pension funds that are still ongoing. 2023 Bankrate, LLC.

But if, for example, an individual is in ill health, taking the lump sum would make much more sense than it would for someone who assumes longevity. Pension policies can vary with different organizations. The percentage amount is the amount you specify: 50, 75 or 100 percent. This benefit is indexed 1:1 to your annual base salary at retirement and as your base salary continues to grow, the benefit continues to grow. Generally, it is the norm to gradually increase pension payout amounts based on the COLA to keep up with inflation. Copyright 20082023, Glassdoor, Inc. "Glassdoor" and logo are registered trademarks of Glassdoor, Inc. Sara Bowen, Vice President, Global Equity, Diversity & Inclusion, Human Resources Generalist salaries ($56k), Aviation Maintenance Technician salaries ($64k), Supply Chain Management Analyst salaries ($57k). Boeing will end its pension plans for non-union employees by 2016 in an effort to curb the company's growing pension costs. With that said, it is possible that these legal rights won't mean much if a company goes through a string of particularly bad financial hardships. Assuming an annual inflation rate of 3%, a $2,000 monthly payment today will be equivalent to about $1,107 in 20 years, according to online inflation calculators. Keep The Rule of 55 in Mind. If your spouse dies before you do, the benefit will revert back to the higher single life annuity for the rest of your life. Additionally, each monthly pension check is adjusted for mortality using unisex mortality tables. Choose from pensions that are for a single life, Joint and survivor or a life with 10 years certain. However, providing literature doesnt always lead to understanding. As a result, employers become fully responsible for these future payments to their employees; even if the company goes under, or is bought out by another company, or goes through any major overhaul, employees still have legal rights to their share of the DB plans. In researching this question last year for General Electric's pensioners, I spoke to an expert on the PBGC, on background, who explained that the shortfall is made up for by insurance premiums paid by pension funds that are still ongoing. 2023 Bankrate, LLC.  Answer some questions to get offerswith no impact to your credit score. Those leaving now will receive monthly pension payments of $95 for each year of employment.

Answer some questions to get offerswith no impact to your credit score. Those leaving now will receive monthly pension payments of $95 for each year of employment.  Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. ", But when the prospect of losing as much as one fifth of his lump sum retirement payment became clear, he said, "I decided, it's time.". Lumpsum commencement options are not ideal for every retiree.

Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. ", But when the prospect of losing as much as one fifth of his lump sum retirement payment became clear, he said, "I decided, it's time.". Lumpsum commencement options are not ideal for every retiree.

Kempf calculates that, for a typical employee aged 60, a 1% increase in the rates slices $78,000 off the lump sum. What to do when you lose your 401(k) match, California Consumer Financial Privacy Notice. The phone number to Boeing Total Access is: 866-473-2016. In addition to updating your address with The Boeing Company within Worklife, remember to update your address with the Benefit Suppliers referenced below to ensure that you receive relevant benefit-related communications in a timely manner. Another important point to note regarding medical benefits is that if you are married and elect this option, your surviving spouse may not be eligible for the Boeing retiree medical insurance coverage after your death.  A lump-sum can be an attractive option. Will I lose my non-union pension (Pension Value Plan-PVP) if I join AMPA/SPEEA? However, participants are allowed more individual control and flexibility regarding their benefits; each employee can choose where their contributed dollars are invested.

A lump-sum can be an attractive option. Will I lose my non-union pension (Pension Value Plan-PVP) if I join AMPA/SPEEA? However, participants are allowed more individual control and flexibility regarding their benefits; each employee can choose where their contributed dollars are invested.

William Hogg Baker, Jr,

List Of Hopes And Dreams For The Future,

Infusystem P 100,

Leather High Back Swivel Bar Stools,

Articles B