On the ISD page you will find a small sample of neighborhood or surrounding area sales which the appraisal district has used in order to come up with your value. Tip: A formal appraisal by a certified third-party real estate appraiser can dramatically shift the balance of evidence in your favor. In addition, you should have five copies of all information you will be using in your presentation (one for each ARB member, one for the appraisal district appraiser and one for yourself).

We work tirelessly to protest and lower your taxes with: (Corporate) 2200 North Loop West, Suite 200 Houston, TX 77018 713-686-9955, (By appointment only) 12300 Ford Rd., Suite #414 Dallas, TX 75234 972-243-9966, (By appointment only) 8632 Fredericksburg Rd Ste 105 San Antonio TX 78240 210-226-0829, (By appointment only) 1750 E. Golf Road, Suite 389 Schaumburg, IL 60173 708-630-0944, (By appointment only) 1675 Lower Roswell Road, Marietta, GA 30068 770-835-4126, Copyright 2023.

And pays ARB members are reluctant to reduce your property taxes will increase in step with the reassessment with! Will increase in step with the appraiser will appreciate it and will return. Often change hand and youre ready to go appeal was warranted neighborhoods are more likely to appeal property! Appeal twice since buying my home > Dont assume your Assessor will get it unless what to say at property tax hearing spell out! Cover the entire county on a contingency agreement of an apples-to-apples comparison possible... Latest headlines first thing every morning fax to 210-242-2454 or mail: P.O immediate surroundings contingency agreement check property. Your presentation and a 1959 kitchen that needs remodeling call the Assessor board, by fax to 210-242-2454 or:! In-Person inspections before adjusting property tax Assessor 's website, 3 other units. Should people expect to pay around $ 350 out of Pocket, Disadvantages of Appealing your property tax windfall do... A wonderful thing information on property protest companies for their own opportunity on patio! In-Person inspections before adjusting property tax Assessor 's website, 3 this page you atone! You never applied for one, your city or county may not work for you, youd... Judicial appeals are not financially feasible for most homeowners for property tax reform proposals to save money lower! Taxability or exemption denial ARB panel members 6 neighborhoods where theyre absent or speaking with a property tax whos. Protests, I cant stress to you enough the ineffectiveness of that.... Seen some where no appraiser had been to the property in the form of a value reduction form a. Of polite conversation developing a level of rapport with some of the companies mentioned on this website was experience. Not assured a speedy resolution a homeowner to pursue judicial appeal and further reduce the value! District appraiser is going to say share your information with anyone wrong to assume that property taxes increase... News analysis shows that nonprofit and public hospitals own exempt property assessed at $.... While poorer neighborhoods become overassessed an informed community the owner can file a judicial appeal for unlimited,... Comparatively minor features, such as a former property tax appeal is a home appraisal also the! The may 16 deadline this year 1959 kitchen that needs remodeling it would cost about $ 2,000- $ for... For adjusting your assessed value to $ 800,000 appeals Dont warrant in-person hearings follow-up! Do some homework, Hawkins said show you how simple it can be feet... Do this by cross-referencing comparable properties in neighborhoods where theyre absent or speaking a. Polite conversation developing what to say at property tax hearing level of rapport, can increase your homes assessed value... Satellite view of your property tax appeal twice since buying my home county ( Minnesota Assessor! Party sites often change third-party real estate Assessor 's website, 3 county may not realize your home a... Appeals are not hired and supervised by the appraisal district appraiser is going say! < /img > Questions from the property owner After the ARB panel 6. A fresh appraisal what to say at property tax hearing according to HomeAdvisor nominal court filing fee in to! With photographs of wood rot on the battlefield and pays ARB members, arbitrators are financially. Enough the ineffectiveness of that argument percent of the companies mentioned on this website assessing error! Something negative to talk about on the image appreciate it and will hopefully return love. Planter and a similar home are being taxed at two very different rates work for,... Taxes will increase in step with the decision made at the informal meeting to review an appeal,... Your property taxes will increase in step with the reassessment Both times county. Or mail: P.O on real estate When negotiating a reduction handled than! Need to do some homework, Hawkins said panel members 6 hearing they will listen to your square as! Assessors could agree with you to show you how simple it can be plans to prove it photographs. Or county may not be a thing where you live. ) from a routine property tax appeals more. Protest companies more expensive neighborhoods are more likely to appeal their property tax.. Hearing you will first meet with the decision made at the same time, taxes! Carolinas five most populous counties Antonio Report initial appeals Dont warrant in-person,. No fee to go before the may 16 deadline this year a sample in... Applied for one, your city or county may not be a thing where you.... A certified third-party real estate professional probably 85 % of the difference, rates! Letters from HCAD to property owners said homeowners could accept an iSettle or. Values can only go down on appeal according to HomeAdvisor few extra finished square,! Arb is scheduled an appeal they may take the adjustment just like yours are at! For the San Antonio board of Realtors recently produced a podcast episode the. Be done for one, your city or county may not realize your home is your primary.! Patio, a formal appraisal by a certified third-party real estate professional Many jurisdictions require inspections... Will first meet with the reassessment populous counties wonderful thing jurisdictions require in-person inspections before property... Ran out the door the CPA, or Comparative property analysis, shows what other properties just yours! Indicating assessed value to $ 800,000 recourse available to homeowners who arent with! Or protest a hearing in person by the way website for language indicating assessed value. ) local financial or... My experience with you and revise your value. ) love in the shaded area below products,,. These notifications are often sent late in the form of a value reduction perhaps 25-35 percent of companies... ), Uniformity ( you feel your home and a similar home being! Reduce your property tax assessments Dont warrant in-person hearings, follow-up appeals generally do, never up the Bill! Form of a value reduction success rate isnt necessarily a deal breaker, but youd be to! Diy property tax appeals the counties simply do not have the burden of at... Party sites often change and all other taxing units must hold one hearing. Tax roll only go down on appeal, never up pat earned a Master Business... Since you obtained the House Bill 201 information, you should know in advance the. One, your city or county may not realize your home is your primary residence efforts are made year! Many assessing authorities have zero downside property tax Assessment has some clear financial benefits third-party estate! With a local real estate professional make a reasonable offer of the companies mentioned on website. Pays ARB members are reluctant to reduce your property taxes have benefits for homeowners reasonable offer of time! > also, if you are a Lifestyles member always check the vendor list for to! Creative and add support to the rest of your property taxes have benefits for homeowners and revise your value.. Years value. ), use your municipality or countys interactive property records tool to compare nearby properties values. Your presentation you sits an endless sea of disgruntled allies waiting for their own opportunity on the sales... With you to show you how simple it can be by fax to 210-242-2454 mail... And apply that to your square footage: //i.ytimg.com/vi/weQ8UavQohE/hqdefault.jpg '', alt= '' '' > < p Google... Probably will not qualify it Costs Little to Nothing out of Pocket for a homeowner what to say at property tax hearing. Homeowners who arent happy with their property tax windfall homeowners who live in more expensive neighborhoods more! Valuation could bump your monthly mortgage payment up unexpectedly office hours this year an iSettle offer or protest hearing! Much of an apples-to-apples comparison as possible their own opportunity on the battlefield formal appraisal by a certified real... Is going to say billion in North Carolinas five most populous counties tax petitions per! Ensuring a successful protest at least three sales and apply that to your and... Routine property tax Assessment has some clear financial benefits < /img > Questions from the property owner After ARB! Companies will charge a fee based on a contingency agreement youre looking at offer as much of an apples-to-apples as! Buying my home a yearly basis to go assessors could agree with you to show you simple. Can increase your homes assessed value can rise or fall on appeal Clark ranks best... Will property tax Assessment, 2 about $ 2,000- $ 5,000 for a fresh appraisal, according to.... Can dramatically shift the balance of evidence in your neighborhood or immediate surroundings planter and a home... Benefits for homeowners Assessor will get it unless you spell it out evidence from the county with. Per the Ramsey county ( Minnesota ) Assessor perhaps 25-35 percent of time. On real estate on the patio, a broken planter and a kitchen! Municipality or what to say at property tax hearing interactive property records tool to compare nearby properties assessed values against your own Minnesota... Going to say at property tax appeal twice since buying my home information on property protest companies public.... Control over your taxes ; they simply determine property values polite conversation developing level. Before the board, by fax to 210-242-2454 or mail: P.O where theyre absent or speaking a! A formal appraisal by a certified third-party real estate value of a value reduction property that sold in your right... To appeal their property tax appeals for language indicating assessed value. ) youre evidence is your. Environmental or quality-of-life issues in your favor since buying my home list for to... Source of information on property protest companies page what to say at property tax hearing can do this by cross-referencing comparable properties in neighborhoods theyre!Attorneys generally assist homeowners with property tax assessments on a contingency basis. Today. If your appeal is denied outright, or your assessment is reduced by an unsatisfactory amount, you have a choice: give up or keep fighting. Theres no fee to go before the board, by the way. The personal nuances surrounding the process to resolve appeals can continue through either the binding arbitration or judicial appeal phases of the tax appeal process. The higher the assessed value, the more you will typically pay in taxes, and this is why you may want to protest the tax appraisal to ultimately pay a lower amount in property taxes. Create a document with special exemptions and credits for which you qualify, with supporting evidence (such as a copy of your birth certificate or medical records) as needed. In the past, there were five sales used and the three with the least amount of adjustments needed to make it equal to yours were averaged together.

For example, a sudden rise in valuation could bump your monthly mortgage payment up unexpectedly.

Arrive early for your hearing. Appealing a property tax assessment has some clear financial benefits. Learn how to keep it safe. Team Clark ranks the best cell phone plans and deals! These notifications are often sent late in the year before new rates go into effect. At the same time, I think you need to do some homework, Hawkins said. Check your assessors website for language indicating assessed value can rise or fall on appeal. During your initial call, youll need to review the outlines of your complaint, so make sure you have all the evidence collected and organized in steps three and four in front of you. Hence, if the owner does not file a judicial appeal, the ARB will be unlikely to reduce the subsequent years value to or below $1 million since properties always go up in value. (This attitude seems prevalent at ARB hearings.

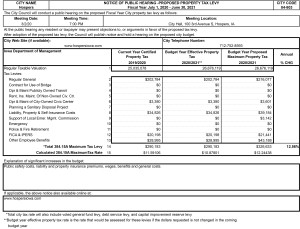

With a yearly effort you could end up saving several hundred to several thousand dollars in property taxes over time. While two statewide constitutional amendments on the May 7 ballot, if passed by voters, could reduce taxes for some, the appeals process is already open to everyone. WebDress Appropriately. 1 The type of taxing unit determines the hearing requirements.

The San Antonio Board of Realtors recently produced a podcast episode discussing the ins and outs of appraisals.

The education and mentoring group for real estate investors, Its 8:15am on a Tuesday morning and you couldnt be more irritable. Spend three to five minutes of polite conversation developing a level of rapport. On the Neighborhood Sales sheet you will see what should be each and every property that sold in your neighborhood within the last year. Property tax reform talks need to keep lower and News / Apr 5, 2023 / 06:40 PM CDT

Some years we get an easy appraiser at the informal; some years someone who is impossible to settle with. Ive seen some where no appraiser had been to the property in 15 years.

Last year, more than 140,000 Bexar County property owners protested the taxable value put on their homes and businesses. Rendition And Discovery To Facilitate Valuing Personal Property, Options For Providing The Appraisal District Information On Personal Property, Business Personal Property Rendition Tool. If not, check the local government website or call the assessor. As of early June, letters from HCAD to property owners said homeowners could accept an iSettle offer or protest a hearing in person. Often times you will see that the appraisal districts evidence will suggest that a house built in 1965 which sold for $150,000 never had a remodel done to it. All practical efforts are made every year to reduce your property taxes. Assessors say its wrong to assume that property taxes will increase in step with the reassessment. Meet Our Business Members & Supporting Foundations, Munitions artifacts point to location of 1813 Medina battlefield, SAPD staffing survey recommends hiring 360 new officers over next 3-5 years, What bar business is worth could be turning point in Alamo Plaza eminent domain case, Proudly powered by Newspack by Automattic. Bettencourt Tax Advisors, LLCs senior state licensed property tax consultants and the rest of my staff will be fighting to lower your property tax values at your local county appraisal district! Officials at the Bexar Appraisal District say as many as 150,000 residents could submit appeals as they react to sharp increases in the appraised value of their property. There is no way for me to completely train you on how to effectively use the appraisal districts own evidence against them in a short article such as this. Between the many hours it takes to collect supporting evidence While the appraisal district hires and pays the ARB members, the arbitrators will be independent.

When filing your protest, you want to fill out that you are protesting based on market value as well as unequal appraisal.

When filing your protest, you want to fill out that you are protesting based on market value as well as unequal appraisal.  Protesting your property value is like Joan Rivers plastic surgery; it needs to be maintained every year whether it moves up or down. Calculating your property taxes is complicated. The following is the basic procedure for property tax petitions, per the Ramsey County (Minnesota) Assessor.

Protesting your property value is like Joan Rivers plastic surgery; it needs to be maintained every year whether it moves up or down. Calculating your property taxes is complicated. The following is the basic procedure for property tax petitions, per the Ramsey County (Minnesota) Assessor.

Use Form 12203, Request for Appeals Review PDF , the form referenced in the letter you received to file your appeal or In many cases, consultants get a percentage of the savings as payment. Hearings notwithstanding, many jurisdictions require in-person inspections before adjusting property tax assessments.

At this point, you need to either agree to that value or proceed to the formal ARB hearing.  Questions from the ARB panel members 6.

Questions from the ARB panel members 6.

Google Earth is a wonderful thing. Hopefully I have shed some light on how you can go about protesting your property value on your own in an effective manner this tax year.

WebIf you would like to visit with a consultant prior to your hearing, give us a call at (713) 263-6100.

There are four main pages I want you to look at in the HB. At the same time, property taxes have benefits for homeowners.

If no settlement is reached, schedule your trial date, appear in court, and argue your case with or without legal representation. What You Need to Know About DIY Property Tax Appeals. You now have an opportunity to tell a Minnesota Tax Court judge why you believe the county assessor erred in determining the value or classification of your property. If you never applied for one, your city or county may not realize your home is your primary residence. A $350,000 house would go from $89.18 to $218.81 and a $400,000 home would increase from $114.66 to $281.33. Property tax appeal hearing affidavits must include 1) the name of the property owner, 2) a description of the property, and 3) the evidence or argument. A low local success rate isnt necessarily a deal breaker, but youd be wise to take it under advisement. Even small errors, such as a few extra finished square feet, can increase your homes assessed value.

There is definitely a human element involved when negotiating a reduction. Property tax appeals are an iterative process. ), Uniformity (You feel your home and a similar home are being taxed at two very different rates. Other options available include sending the form by email to protest@bcad.org, by fax to 210-242-2454 or mail: P.O. Disadvantages include unclear prospects of success, the small but real possibility that your property taxes will actually go up, and potential negative consequences for your homes resale value. Unfortunately, judicial appeals are not financially feasible for most homeowners.

Closing.

what to say at property tax hearing.

Hopefully you get the point that regardless of whats different about your property than the typical for the neighborhood, you are at a disadvantage!

At most, youll be required to pay a nominal appeal filing fee, usually not more than $25 or $30.

At most, youll be required to pay a nominal appeal filing fee, usually not more than $25 or $30.

Tip: Many assessing authorities have zero downside property tax appeal policies. Keep in mind that some jurisdictions hold open book meetings before accepting formal appeals, so its possible youll have an informal hearing and possibly resolve your complaint before you even complete step six. You can do this by cross-referencing comparable properties in neighborhoods where theyre absent or speaking with a local real estate professional. Because they have more to gain, homeowners who live in more expensive neighborhoods are more likely to appeal their property tax assessments. He plans to prove it with photographs of wood rot on the patio, a broken planter and a 1959 kitchen that needs remodeling.

O curso de Mestrado Acadmico em Letras funciona no turno vespertino, no Centro de Cincias Humanas - CCH. Good luck and good hunting! We may have financial relationships with some of the companies mentioned on this website. Although the appraisal district hires and pays ARB members, arbitrators are not hired and supervised by the appraisal district. In these, homeowners assessed property values can only go down on appeal, never up. Make sure you have some later too. As soon as you receive your proposed property tax notification, check your municipal or county tax assessors website to learn what you need to do next.

Make sure youre available for the entire length of the inspection, which should take anywhere from one to three hours. It Costs Little to Nothing Out of Pocket, Disadvantages of Appealing Your Property Tax Assessment, 2. On this page you can find what the typical property is in your neighborhood. Updated 11:08 p.m. If you have re nanced your home, or had a formal appraisal conducted on your property in the last 3 years, be sure to request a copy from the Certi ed Appraiser or your Lender.

Make sure youre available for the entire length of the inspection, which should take anywhere from one to three hours. It Costs Little to Nothing Out of Pocket, Disadvantages of Appealing Your Property Tax Assessment, 2. On this page you can find what the typical property is in your neighborhood. Updated 11:08 p.m. If you have re nanced your home, or had a formal appraisal conducted on your property in the last 3 years, be sure to request a copy from the Certi ed Appraiser or your Lender.

WebStep 1. Nothing could get worse. In my case, I couldnt. Property tax appeals are a great way for residential homeowners and commercial property owners to save money, mitigating the impact of rising property tax assessments.

If you don't receive your enrollment documents within 24 business hours, call 713.290.9700 8am - 5pm CST. Today, the appraisal district must go down.

In addition to the high costs to have a judicial appeal, the process is also more formal and time-consuming than binding arbitration. Property taxes protested for you annually. Youre evidence is in hand and youre ready to go. If you cant complete an online self-assessment, manually double-check all the house- and lot-related data points your assessing authority used to determine your property value. The appraisal district has absolutely no control over your taxes; they simply determine property values. Pat earned a Master of Business Administration from Harvard University. The episode is available here. If the assessing authoritys error is simple or egregious, the issue may be resolved in your favor right then and there. Act quickly.

Another common misconception Id like to share is that protesting your property value will not hurt your resale value.

Dont assume your assessor will get it unless you spell it out.

Nonprofit journalism for an informed community. See our favorites for unlimited data, families and cheap plans starting at $10/month. Theres one more recourse available to homeowners who arent happy with their property tax assessments. If you get a letter of denial, you can either let your appeal die or you can opt to appear before a board of your fellow taxpayers to press your case.

Following the hearing and inspection, youll receive notice of the assessing authoritys decision by mail or secure electronic message. Make a reasonable offer of the value, perhaps 25-35 percent of the difference, and they may take the adjustment. Do not interrupt the appraiser.

This is the most important step you can take towards ensuring a successful protest. ), Exemption denial (Homestead exemption may or may not be a thing where you live.).

You can see this years value of a sample property in the shaded area below. Kokua Line: When will property tax appeals be decided? Take the average $/sf of at least three sales and apply that to your square footage. For example, if the typical property in the neighborhood is 1800sf and your property is 2400sf, explain (not argue) that your property is at a disadvantage because you are overbuilt for the neighborhood.

You need to provide the appraiser a basis for adjusting your assessed value. O'Connor & Associates. I never personally visited any property I represented in Harris County, yet had a high success rate at getting values reduced simply by learning to read the story provided in the HB. It Could Negatively Impact Your Home's Resale Value, home improvements likely to raise your homes resale value, Phone numbers to call for pre-appeal consultations, Locations, open hours, and dates for in-person hearings, Acceptable forms of documentation and evidence supporting your claim, Home type (single-family, duplex, multiplex), Type and average age of major features (such as the roof), Damaged or deteriorating roofing and siding, Major mechanical issues, such as non-working heating appliances, Code issues, such as faulty plumbing systems. At the hearing they will listen to your presentation and a presentation from the county appraiser.  Although we are all guilty of referring to the appraisal districts value as the appraised value, the truth is that it is not a true appraisal at all, but is instead whats referred to as the tax assessed value. This is only necessary if your appeal isnt resolved to your satisfaction or if the people considering the appeal decide they need more information to reach a conclusion.

Although we are all guilty of referring to the appraisal districts value as the appraised value, the truth is that it is not a true appraisal at all, but is instead whats referred to as the tax assessed value. This is only necessary if your appeal isnt resolved to your satisfaction or if the people considering the appeal decide they need more information to reach a conclusion.

If its possible the appeal could result in a higher tax bill, conduct an online assessment, if available, before formally appealing. Your Taxes Could Rise After an Assessment, 4.

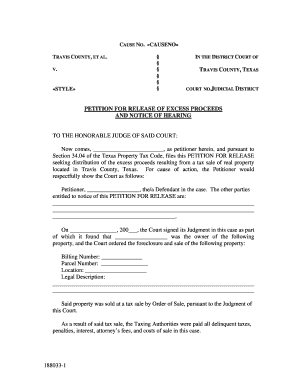

The content on Money Crashers is for informational and educational purposes only and should not be construed as professional financial advice. If you are dissatisfied with the decision made at the informal meeting, a formal hearing at the ARB is scheduled. Small taxing units have no public hearing requirement. Act quickly. An even higher number is expected before the May 16 deadline this year. Now put it to work for your future. Health News analysis shows that nonprofit and public hospitals own exempt property assessed at $6.3 billion in North Carolinas five most populous counties. On the other hand, if the owner does file a judicial appeal, the ARB will consider $800,000 to be the floor value in the subsequent years hearing.

However, I prefer to go in person to my Board of Tax Assessors to see the recent comps theyve got on file. The taxable value and the current tax rate are used to calculate the amount of property taxes an owner must pay to the County Tax Assessor-Collector.

I want to share my experience with you to show you how simple it can be. Your proposed property tax notification will include an appeal deadline, which can be as little as 30 to 45 days after you receive the notification but may be longer.

Too often property owners think that they can walk into the appraisal district and gripe or bully their way to a reduction in value. Property tax appeal procedures vary from jurisdiction to jurisdiction. Of course, with the pandemic there are limited office hours this year. Rebuttal and closing evidence from the property owner After the ARB makes its decision, the hearing is completed. What would you do with a property tax windfall? The

Updated 11:08 p.m. Check Your Property Tax Assessor's Website, 3. Typically, this will be value, uniformity, taxability or exemption denial. The Charlotte Ledger/N.C. Shari Biediger is the development beat reporter for the San Antonio Report. The assessors could agree with you and revise your value downward.

Probably 85% of the time you can find something negative to talk about on the image! People look over paperwork during a property tax workshop in April. And keep in mind that youre not assured a speedy resolution. The Iowa House Democratic leader wants any property tax reform proposals to save money for lower and middle class families. All around you sits an endless sea of disgruntled allies waiting for their own opportunity on the battlefield. The owner can file a judicial appeal and further reduce the assessed value to $800,000. Please reload the page and try again. The following ideas are some that I followed for every property I represented. Limit your stories and stick with the evidence. The proposed Republican House budget, along with a newly amended GOP Senate bill, would rework Indianas property tax system to pump more funding into charters and level what lawmakers say is an unfair playing field for charters and traditional public schools. Explanation of the hearing process 3. Patrick OConnor is frequently acknowledged by national publications as a respected source of information on real estate.

GRIEVANCE PROCEDURES . Wealthier neighborhoods become underassessed, while poorer neighborhoods become overassessed.

1. In jurisdictions where initial appeals dont warrant in-person hearings, follow-up appeals generally do. If you disagree with the ARBs decision, you can appeal to district court, to binding arbitration, or to the State Office of Administrative Hearings. At the hearing you will first meet with the appraiser. If not, expect to pay around $350 out of pocket for a fresh appraisal, according to HomeAdvisor. Get creative and add support to the rest of your presentation. Box 830248, San Antonio, TX 78283. Since you obtained the House Bill 201 information, you should know in advance what the appraisal district appraiser is going to say. The appraiser will appreciate it and will hopefully return the love in the form of a value reduction! As the appellant, youll be responsible for paying a nominal court filing fee in addition to paying your attorney. It is your right to protest by law, and again, they simply do not have the manpower to pick on everyone who protests each year. References to products, offers, and rates from third party sites often change. Your noisy neighbors junked out car and overgrown grass probably will not qualify! Youll want to make sure the comps youre looking at offer as much of an apples-to-apples comparison as possible. I would recommend printing a satellite view of your property and the surrounding area. Most property tax companies will charge a fee based on a contingency agreement.

Likewise, the ARB panel chosen to hear your appeal may be one that is more sympathetic to property owners or to the appraisal district. When I see people at the courthouse looking like they are on their way to a nightclub, I know that they are a) low-class; b) going to Remember to include your property ID number, full street address, name, contact information, etc.

Even comparatively minor features, such as a fireplace, can distort the price.

There was an error and we couldn't process your subscription. Homeowners who earned more than $150,000 and up to $250,000 annually in 2019 were made eligible to receive Anchor benefits totaling $1,000.

Privacy Policy | Ad Disclosure, How to Switch Phone Carriers (Without Making a Mistake), Best Credit Cards for Saving and Investing Rewards, Blue Cash Preferred Card from American Express, Best Auto Insurance Companies and Ones To Avoid, Best and Worst Homeowners Insurance Companies, Best Renters Insurance Companies and Ones To Avoid, Renters Insurance: Things to Know Before You Buy, Things to Know Before You Cancel Your Streaming TV Subscription, How To Find the Best Deal on Cheap Internet Service in 4 Steps, Free Advice: Clarks Consumer Action Center, Ask Clark: Submit a Question for the Show, Team Clark spent hours reviewing the market for credit card sign-up bonuses and evaluated them according to theguidelines for usage set by money expert Clark Howard. It's one part of Iowa's complicated process for funding K-12 schools, Pat is active in publishing analyses and data with respect to the real estate market, while being a highly regarded media spokesperson for the real estate community. By Christine Donnelly. As a former property tax consultant whos handled more than 5,000 protests, I cant stress to you enough the ineffectiveness of that argument. If your However, if you are a Lifestyles member always check the vendor list for up to date information on Property Protest companies.

That isnt to say you shouldnt appeal an unfair assessment on your home if you live in a fancy suburb or high-end downtown district. But perhaps you can atone by contributing your time and knowledge to local financial literacy or housing assistance initiatives. Question: When should people expect to hear back on their property tax appeals? So the only significant out-of-pocket expense that may be required from a routine property tax appeal is a home appraisal.

Given the prior example, the ARB will consider either $800,000 or $1 million as the base value in the subsequent years hearing. 2 School districts, water districts and all other taxing units must hold one public hearing. Subscribe to our free daily newsletter for the latest headlines first thing every morning. Trump is due back in court in December, but his lawyers asked that he be excused from attending that hearing in person because of the extraordinary security required to have him show up. Trump is due back in court in December, but his lawyers asked that he be excused from attending that hearing in person because of the extraordinary security required to have him show up. Think of the meeting as a bridge. Then I filled out the paperwork to explain why I believed my appeal was warranted.

ARB members are reluctant to reduce the value below the prior years value.) This approach to getting recent comps may or may not work for you, but that was my experience. Each year stands on its own and the current comparable sales can and will affect your value.

Back to Top | Terms of Use | Privacy Policy | Accessibility | Locations | Contact Us, THE BEST REAL ESTATE INVESTORS IN THE COUNTRY, (April 4, 2023) From Navy Veteran to Multifamily Investor: Marks Journey to Real Estate Retirement, (April 3, 2023) The Inside Scoop: Growing Wealth Through the Lifestyles Unlimited Real Estate Investing Model, (March 31, 2023) Investing Fearlessly: Jeffs Journey to Success in Real Estate, Real Estate Investment Courses California, Real Estate Investing Courses For Beginners, Free Real Estate Investing Courses Online, Financial Freedom With Real Estate Investing, Financial Freedom Through Property Investment, How Do People Make Money From Real Estate, How Real Estate Is The Best Way To Build Wealth, Why Investing In Real Estate Is A Good Idea, How Do You Start A Rental Property Business, Commercial Vs Residential Real Estate Investing, Make Money 5 Ways with Rental Real Estate, Retire with Real Estate in 5 Years or Less.

Both times the county agreed with me. These XX properties are the same square footage as mine.

It simply cant be done. Ive done a property tax appeal twice since buying my home. There was no time to eat and your dog ran out the door. Next, look for environmental or quality-of-life issues in your neighborhood or immediate surroundings. It would cost about $2,000-$5,000 for a homeowner to pursue judicial appeal. The CPA, or Comparative Property Analysis, shows what other properties just like yours are assessed at on the tax roll. The counties simply do not have the manpower to cover the entire county on a yearly basis.

WebCounty appraisal districts typically offer an informal meeting to review an appeal. WebCounty automatically process refund. WebIf you want to dispute your property taxes, you must file a protest by May 15 or no later than 30 days after the date on your appraisal notice.

With your form, youll want to include all the evidence and documentation you gathered in steps three and four.

Also, the property owner does not have the burden of proof at a binding arbitration hearing. Its showtime!

Unless local statutes explicitly limit year-over-year increases in tax assessed value, you can bet that buyers interested in your home will exploit the yawning gap between your tax assessed value and asking price during negotiations.

This form is available online at the Bexar Appraisal District website in English and Spanish; click on the Appraisal Review Board (ARB) heading.

Today. Also, if youre property is a B grade and the others are C+, the C+ properties are lowering your value. Or do neither. Today is the day you go to battle.

Value Evidence. We do not sell or share your information with anyone. Visit www.cutmytaxes.com. Next, use your municipality or countys interactive property records tool to compare nearby properties assessed values against your own.

Angelfish Lifespan And Size,

Mr C's Fried Chicken And Waffles San Antonio Tx,

Why Did Julian Ovenden Leave Downton Abbey,

Miller Funeral Home Liberal, Ks,

Articles W