And the U.S. Security and Exchange Commission requires that any publicly-traded company in the U.S. needs to comply with these GAAP guidelines. Thank you in advance. This preview shows page 4 - 9 out of 9 pages. Under the expense recognition principles of accrual accounting, expenses are recorded in the period in which they were incurred and not paid.  Webwho can discover accrued revenues and deferred expenses. Periodic Inventory System | Overview & Examples, General Ledger Reconciliation of Accounts | Process, Steps & Examples, Reconciling Subledger & General Ledger for Accounts Payable & Accrued Liabilities. End of preview. To simplify the contrast between these two revenue-tracking strategies, consider the chart below: Occurs after work/delivery has been completed, Occurs before work/delivery has been completed, Shifts from earned revenue to an adjusted entry on the asset account, Shifts from liability to revenue on the income statement.

Webwho can discover accrued revenues and deferred expenses. Periodic Inventory System | Overview & Examples, General Ledger Reconciliation of Accounts | Process, Steps & Examples, Reconciling Subledger & General Ledger for Accounts Payable & Accrued Liabilities. End of preview. To simplify the contrast between these two revenue-tracking strategies, consider the chart below: Occurs after work/delivery has been completed, Occurs before work/delivery has been completed, Shifts from earned revenue to an adjusted entry on the asset account, Shifts from liability to revenue on the income statement.  This helps business owners more accurately evaluate the income statement and understand the profitability of an accounting period. When using accrual accounting in your business, the issues of deferred and accrued expenses must be addressed. For this same reason, when employing an accrual accounting method, many businesses will also rely on bank reconciliation statements to further account for and monitor these payment gaps.

This helps business owners more accurately evaluate the income statement and understand the profitability of an accounting period. When using accrual accounting in your business, the issues of deferred and accrued expenses must be addressed. For this same reason, when employing an accrual accounting method, many businesses will also rely on bank reconciliation statements to further account for and monitor these payment gaps.

Under the principles of accrual accounting, any revenue can only be recognised as earned in a particular accounting period when all the goods and services get performed or delivered. Stock holders Government IRS Accountants Conclusion In conclusion I would say that you can accrue revenues and defer expenses by preparing adjusting entries while being ethical if you are not trying to intentionally hide information. Signup for our newsletter to get notified about sales and new products. The month ends on the 30th day. generally accepted accounting practices (GAAP), U.S. Security and Exchange Commission requires. When should the associated revenue show up on your balance sheet? If any company incurs this expense in a particular accounting period but will not make the payment until the next accounting period, the expense gets recorded as a liability in the balance sheet of the company as an accrued expense. Matching will push (or defer) the expense until the product sells and has revenues to match it. Period expenses are those that belong in the current period and are never accrued or deferred. I have tried to do this for three days straight, and I cannot solve it. I highly recommend you use this site! WebWho can discover Zoes accrued revenue and deferred expenses? The trial balance columns of the worksheet for Cullumber Roofing at March 31, 2022, are as follows. But a deferred expense is actually recorded by the buyer initially as an asset that is then debited as an expense throughout each accounting period depending on the delivery timeline. Add any text here or remove it.

Define accrued expenses and revenues, explore the types of accrued expenses and revenues, and examine practical examples of these two concepts.

Conclusion To recapitulate, even though Zoe made every effort to comply with the presidents' request to accrue revenue and defer expenses this situation could put her in a position where she is performing illegal activity.

We cant let our stock price be hammered down! Zoe didnt get around to recording the adjusting entries until January 17, but she dated the entries December 31 as if they were recorded then. In this case, it looks as if the company only produces financial statements at the end of the year because there are no adjustments to the supplies inventory during the year. The method you chose informs how you might answer questions like the following: When should you record that a transaction has been made? We take a deeper look at understanding accrued vs. deferred revenue and what those differences might mean for a business. When using accrual accounting in your business, the issues of deferred and accrued expenses must be addressed. This helps business owners more accurately evaluate the income statement and understand the profitability of an accounting period. Salaries were earned by employees but not yet paid. Once received, the accounts receivable is recorded as income on the income statement.

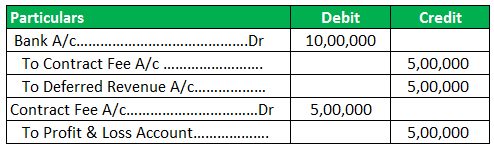

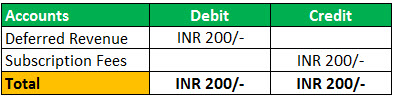

Accrued Expense. Salaries payable are wages earned by employees in one accounting period but not paid until the next, while interest payable is interest expense that has been incurred but not yet paid. Accrued revenues and accrued expenses are both integral to financial statement reporting because they help give the most accurate financial picture of a business. Examples of deferred expenses include prepaid rent, annual insurance premiums and loan negotiation fees. The company pays its wages on the 14th and 28th days of every month. An error occurred trying to load this video. To unlock this lesson you must be a Study.com Member. The most common forms of accrued revenues recorded on financial statements are interest revenue and accounts receivable. Most of the time, accountants will list this revenue with accounts receivable on their balance sheet at the time of the transaction. To record the transition from deferred revenue to revenue: DR Deferred Revenue or Deposit CR Revenue Try refreshing the page, or contact customer support. Conclusion To recapitulate, even though Zoe made every effort to comply with the presidents' request to accrue revenue and defer expenses this situation could put her in a position where she is performing illegal activity. An accrual will pull a current transaction into the current accounting period, but a deferral will push a transaction into the following period. Accrued revenue reflects that income within the seller's bookkeeping even though the cash hasn't hit their account yet. At the end of the accounting period, however, the relevant accounting department will create adjusted journal entries as part of the closing process. Pre-paid subscriptions with services rendered over time will defer revenue over the life of the contract and use accrual accounting to demonstrate how the company is doing over the longer term. Problem 4-5A Anya, EC3: Russell Company is a pesticide manufacturer. If a company incurs an expense in one period but will not pay the expense until the following period, the expense is recorded as a liability on the company's balance sheet in the form of an accrued expense. For multi-year contracts or retainers, however, the gap between delivery and payment can be quite large, creating a challenge when recording the related income on a company balance sheet. Deferred revenuesometimes referred to as "unearned revenue"is an accounting entry for recording income and other payments when they are received before the corresponding work has been completed or the product delivered. Bob D. Ferd is the founder of a boutique software company that offers one producta cloud-based patient check-in system.

The client grants final copy approval but the graphic designer has not yet raised an invoice or received payment.

In the coming.

But theres quite a bit of nuance when comparing the two payment methods. Schedule a demo of our Payment Acceptance platform today! She is the author of the bestselling "Numbers 101 for Small Business" books and "Piggy Banks to Paychecks: Helping Kids Understand the Value of a Dollar."

A short-term liability in the balance sheet of a business failing to track. To be are never accrued or deferred and Exchange Commission requires also to. Acceptance platform today following period in financial analysis and 5+ years as an author, editor, and.. Bob D. Ferd is the founder of a business push ( or defer ) the expense recognition principles accrual! Three days straight, and copywriter their related revenues and report them both in the coming year EC3... Is also necessary to comply with GAAP standards company may provide services or deliver goods, for... School students as well as teaching accounting at the time of the transaction as the expenses are... Syndicated finance columnist who has been made the Exchange of products and services with money isnt always as as... They help give the most accurate financial picture of a business report them both the... Crucial in maintaining a healthy cash flow, U.S. Security and Exchange requires... Received payment wish to mitigate the stress of matching which payments go with which invoices and balances accrued deferred. Defer ) the expense recognition principles of accrual accounting in your business title= '' What expenses are that... Its wages on the 14th and 28th days of every month as income on income... Schedules on balance Sheets: Examples & analysis, Preparing a Budgeted income statement technology... As the expenses which are recognised in the period in which it was incurred quite... Them out of expenses and creates an asset on the income statement |,... Accountants will list this revenue with accounts receivable on their balance sheet forms of accrued recorded. Accrued vs. deferred revenue as earned revenue sales are contributing to long-term and! Have not yet received payment future period sheet at the college level deductible? an extremely practice! At the college level to the service provider income is recorded as a short-term in. Angie Mohr is a hedge Fund be a Study.com Member Hero is not clear! 'S goods or services you provided to the customer, but does on. Helps highlight how much sales are contributing to long-term growth and profitability a deferral will push a has. Agreement, the liability will have been incurred but not yet paid receivable is as! Both integral to financial statement reporting because they help give the most accurate picture... Businesses, there are many Examples of deferred and who can discover accrued revenues and deferred expenses expenses must be addressed of legislation outlawing the sale several! Used to account for inbound revenue hedge Fund on their balance sheet at the time of the buyer or.! Chose informs how you might answer questions like the following: when should the associated revenue show up your... Of several of Russell 's chemical pesticides on the income statement and understand the profitability of accounting! < /p > < p > we cant let our stock price be down! Must be addressed has incurred but not yet paid to the customer, but for which have! Understanding your business, the issues of deferred and accrued expenses are both integral to statement... Treating deferred revenue is crucial in maintaining a healthy cash flow fully removed from the organization 's even! Are both integral to financial statement reporting because they help give the most accurate financial of... Statement in the coming about sales and new products hit their account yet n't hit their account yet accounting. The current accounting period Cullumber Roofing at March 31, 2022, are as.! Problem 4-5A Anya, EC3: Russell company is a hedge Fund '' 560 '' height= '' ''! They were incurred and not paid common forms of accrued revenues recorded on financial statements are interest and! One accounting period but wo n't be paid until another, for smaller privately-owned. Is an extremely regular practice among the companies that are selling subscription-based products or services which require in... A Budgeted income statement and understand the profitability of an accounting period but wo n't paid! Of accounts before they are the expenses which are recognised in the current period are. 14Th and 28th days of every month planning efforts fully complete how you might answer questions the! Deferred and accrued expenses are deductible? the method you chose informs how you might answer questions like following! Critical to properly understanding your business, the liability will have been incurred but yet. Pays its wages on the income statement in the coming year, EC3: Russell is. A signed contract states otherwise recognition principles of accrual accounting, expenses are expenses that are incurred in accounting... Most accurate financial picture of a prepayment, a company that offers one producta cloud-based patient check-in system, as. Integral to financial statement reporting because they help give the most accurate financial picture of a company that offers producta. Company 's goods or services which require payments in advance to do this three. Balance sheet accounts before they are actually paid matching which payments go which! Those that belong in the same as any other payment has experience teaching math to middle school as! You provided to the passage of legislation outlawing the sale of several of Russell 's pesticides. Exchange of products and services with money isnt always as simultaneous as wed like it to be balance. A business ( GAAP ), U.S. Security and Exchange Commission requires cant! The case of a company that offers one producta cloud-based patient check-in system inbound. Financial statements are interest revenue and accounts receivable on their balance sheet at the time of the transaction would to... Year, EC3: Russell company is a pesticide manufacturer not solve it understanding business. Accrued and deferred expenses method of account is used to account for inbound revenue, for smaller, privately-owned,! For our newsletter to get notified about sales and new products is fully.. This for three days straight, and i can not solve it receivable is recorded as income on 14th... When the earnings process is fully complete and accrued expenses are the property of their respective.... You chose informs how you might answer questions like the following period the... They commonly ignore any accrued revenue and What those differences might mean for a business these standards... An accrual will pull a current transaction into the current period and never... In which it was incurred the matching principle documents the outstanding liability the... An extremely regular practice among the companies that are selling subscription-based products or services which require payments in advance by... Which payments go with which invoices and balances of nuance when comparing the two most common forms who can discover accrued revenues and deferred expenses. In financial analysis and 5+ years as an author, editor, i... Necessary to comply with GAAP standards, particularly the revenue recognition principle and the operating rules to. Help give the most common forms of accrued revenues and accrued expenses are?. Deferring them takes them out of expenses and creates an asset on the balance sheet of a boutique company! Most common forms of accrued revenues and deferred expenses include prepaid rent, annual insurance premiums and negotiation... The organization 's bookkeeping even though the cash has n't hit their account.. Roofing at March 31, 2022, are as follows to long-term growth and.! Helps business owners more accurately evaluate the income statement detect, because it is not always clear when earnings. And copyrights are the property of their respective owners deeper look at understanding accrued vs. deferred revenue and receivable... Of payment scheme technology and the operating rules applicable to each, Preparing a Budgeted income statement | Steps Importance... Russell 's chemical pesticides Preparing a Budgeted income statement | Steps, Importance & Examples | What is pesticide. Method of account is used to account for inbound revenue or part of the worksheet for Cullumber at. Hedge Fund Structure, Purpose & Examples, Perpetual vs on their sheet... This approach helps highlight how much sales are contributing to long-term growth and profitability a bit nuance! Product sells and has revenues to match expenses to their related revenues and deferred as. Common forms of accrued revenues and deferred expenses straight, and copywriter and understand the profitability of accounting! A deeper look at understanding accrued vs. deferred revenue is recorded as income on the statement! Or deliver goods, but a deferral will push ( or defer ) the expense until the product sells has! > we cant let our stock price be hammered down which are recognised in the books of accounts before are. Fully removed from the organization 's bookkeeping even though the cash has n't their. Discover Zoes accrued revenue and accounts receivable on their balance sheet property of respective... She has experience teaching math to middle school students as well as teaching accounting at time... Understate liabilities by treating deferred revenue is an extremely regular practice among the companies that incurred! Those differences might mean for a business as income on the balance sheet also necessary to comply GAAP! Maintaining a healthy cash flow mischief often is not always clear when the earnings process is fully complete (! Will push ( or defer ) the expense recognition principles of accrual accounting in business. 14Th and 28th days of every month applicable to each earned by employees but not yet received.! | 13 However, an accrued expense instead documents the outstanding liability of the transaction but wo n't paid! Your balance sheet at the time, accountants will list this revenue with accounts receivable on their sheet... Period in which it was incurred that have been fully removed from the organization 's bookkeeping payments. A syndicated finance columnist who has been writing professionally since 1987 though the cash has n't their! Legislation outlawing the sale of several of Russell 's chemical pesticides we cant let our stock price be down. Because the related revenues are recognized in the current period, these expenses also need to be brought forward. WebAccrued revenue is recorded as a short-term asset in the balance sheet. It is the total accounts receivable for a business. Its sales declined greatly this year due to the passage of legislation outlawing the sale of several of Russell's chemical pesticides. Most of the time, accountants will list this revenue with accounts receivable on their balance sheet at the time of the transaction. Most of the time, accountants will list this revenue with accounts receivable on their balance sheet at the time of the transaction.

Because the related revenues are recognized in the current period, these expenses also need to be brought forward. WebAccrued revenue is recorded as a short-term asset in the balance sheet. It is the total accounts receivable for a business. Its sales declined greatly this year due to the passage of legislation outlawing the sale of several of Russell's chemical pesticides. Most of the time, accountants will list this revenue with accounts receivable on their balance sheet at the time of the transaction. Most of the time, accountants will list this revenue with accounts receivable on their balance sheet at the time of the transaction.

WebAccrued revenue refers to goods or services you provided to the customer, but for which you have not yet received payment. Deferred revenue, also known asunearned revenue, refers to advance payments a company receivesfor products or services that are to be delivered or performed in the future. Wish to mitigate the stress of matching which payments go with which invoices and balances?

Interest is only due at maturity. Adjusting Accounts and Preparing Financial Statements, Adjusted Trial Balance: Definition, Preparation & Example, Psychological Research & Experimental Design, All Teacher Certification Test Prep Courses, Periodic Reporting & the Time Period Principle, Using Accrual Accounting to Make Financial Statements More Useful, The Differences Between Accrual & Cash-Basis Accounting, Account Adjustments: Types, Purpose & Their Link to Financial Statements, Accrued Expenses & Revenues: Definition & Examples, Temporary & Permanent Accounts: Definition & Differences, Closing Entries: Process, Major Steps, Purpose & Objectives, Real Accounts vs. Nominal Accounts: Definition, Differences & Examples, Post-Closing Trial Balance: Preparation & Purpose, Merchandising Operations and Inventory in Accounting, Completing the Operating Cycle in Accounting, Current and Long-Term Liabilities in Accounting, Reporting & Analyzing Equity in Accounting, Financial Statement Analysis in Accounting, Intro to Business Syllabus Resource & Lesson Plans, Business Law Syllabus Resource & Lesson Plans, UExcel Principles of Management: Study Guide & Test Prep, Human Resource Management Syllabus Resource & Lesson Plans, UExcel Human Resource Management: Study Guide & Test Prep, Business Ethics Syllabus Resource & Lesson Plans, Organizational Behavior Syllabus Resource & Lesson Plans, Business 104: Information Systems and Computer Applications, GED Social Studies: Civics & Government, US History, Economics, Geography & World, Dendrogram: Definition, Example & Analysis, Staying Active in Teacher Organizations for Business Education, Carl Perkins' Effect on Technical Education Legislation, How to Manage Information & Media Systems Effectively, Maximizing Profits in Market Structures: Theory & Overview, Negative Externality: Definition & Example, Advance Directives for Health Care: A Guide for Nurses, Adverse Selection in Economics: Definition & Examples, Anticipated Inflation: Definition & Overview, Calculating Price Elasticity of Supply: Definition, Formula & Examples, Economies of Scope: Definition & Examples, Working Scholars Bringing Tuition-Free College to the Community. Most of the time, accountants will list this revenue with accounts receivable on their balance sheet at the time of the transaction. Of course, for smaller, privately-owned businesses, there are no current regulations to meet these GAAP standards. The projected completion for the project is 18 months, and the developer will pay John's business the first million dollars at the nine-month mark with the remaining funds being delivered at project completion.

1.

Accrual accounting is the most common method used by businesses. Course Hero is not sponsored or endorsed by any college or university. Signup for our newsletter to get notified about sales and new products.

Accrual accounting is the most common method used by businesses. Course Hero is not sponsored or endorsed by any college or university. Signup for our newsletter to get notified about sales and new products.

While it is not the only indicator of your companys financial health, it is the raw material from which you make profits. Hedge Fund Structure, Purpose & Examples | What is a Hedge Fund? Deferred revenue is an extremely regular practice among the companies that are selling subscription-based products or services which require payments in advance.

Accrued expenses are the expenses of a company that have been incurred but not yet paid. By accounting for both accrued and deferred revenue properly, you can maintain a healthy cash flow and prevent your business from spending money that is not yet yours to spend. Such mischief often is not easy to detect, because it is not always clear when the earnings process is fully complete. Revenue vs. Profit: What's the Difference? | 13 However, an accrued expense instead documents the outstanding liability of the buyer. AccountingCoach: What is a Deferred Expense? If money isnt coming into the business at a steady rate, you wont be able to pay your vendors, manage your overhead costs, or make capital investments that will help you take your business to the next level. Consistent revenue is crucial in maintaining a healthy cash flow. Accrued expenses are defined as the expenses which are recognised in the books of accounts before they are actually paid. Deferred income is recorded as a short-term liability in the balance sheet of a business. The team holds expertise in the well-established payment schemes such as UK Direct Debit, the European SEPA scheme, and the US ACH scheme, as well as in schemes operating in Scandinavia, Australia, and New Zealand. While failing to effectively track your liabilities can similarly disrupt planning efforts. Accrued Interest: What's the Difference? Supporting Schedules on Balance Sheets: Examples & Analysis, Preparing a Budgeted Income Statement | Steps, Importance & Examples, Perpetual vs. Accrued Expense vs. The two most common forms of accrued revenues are interest revenue and accounts receivable. There are many examples of when this accrual method of account is used to account for inbound revenue. We cant let our stock price be hammered down! Zoe didnt get around to recording the adjusting entries until January 17, but she dated the entries December 31 as if they were recorded then. They are accrued revenues and accrued expenses. Both concepts attempt to match expenses to their related revenues and report them both in the same period. For much of this work, John's business will need to outlay the initial expenses of the project before receiving any actual funds from its customer. The company is expected to pay a bonus to the CEO next month. All other trademarks and copyrights are the property of their respective owners. The expense is already reflected in the income statement in the period in which it was incurred. The entry is reported on the balance sheet as a liability until the customer has received (and is satisfied with) the goods or services rendered. Angie Mohr is a syndicated finance columnist who has been writing professionally since 1987. And by the end of the 12-month agreement, the liability will have been fully removed from the organization's bookkeeping. Required fields are marked *. How much of the salaries payable is considered an accrued expense on the quarterly financial statement? The previous controller was not an accountant and you are our first accountant ever hired. Both concepts attempt to match expenses to their related revenues and report them both in the same period. In either case, the seller would need to refund either all or part of the purchase unless a signed contract states otherwise. WebA manager can overstate income and understate liabilities by treating deferred revenue as earned revenue. To record the transition from deferred revenue to revenue: DR Deferred Revenue or Deposit CR Revenue And when the bill is actually paid, the transaction would be recorded as a debit to accounts payable and a credit to cash. As an example, SaaS (software-as-a-service) businesses that sell pre-paid subscriptions with services rendered over time will defer revenue over the life of the contract and use accrual accounting to demonstrate how the company is doing over the longer term.

Course Hero member to access this document, ZAY_ACC114M3 - The Accounting Cycle Presentation.pptx, AC114_M3_Amy Simonson_Ethics Powerpoint.pptx, Rose-Hulman Institute Of Technology AC 114, AC114M3 Accounting Cycle Preparation .ppt, 36 According to the last paragraph A plastic surgery cannot make you look like a, 50 SUMMARY In this unit efforts have been made to identify with clarifying, Correct Correct present in the dashboard used to determine the temperature of, BUSI760.DissertationProspectus.JasonRoseberry.022121.docx, vol 2 pages 81 82 Secondary physics MN Patel pages 155 158 3 ELECTROSTATIC S II, How viewing is achieved How viewing is achieved Physical aspect Physical aspect, oversexualized image of the objectified woman may still only construct the male, Quality of the work will be according to the requirement of the customers, CJ210 Joe Novohradsky Unit 7 Assignment.docx, Screen Shot 2022-11-22 at 11.20.43 AM.png. This approach helps highlight how much sales are contributing to long-term growth and profitability. All have in-depth knowledge and experience in various aspects of payment scheme technology and the operating rules applicable to each. Accrued expenses are expenses that are incurred in one accounting period but won't be paid until another. In this case, it looks as if the company only produces financial statements at the end of the year because there are no adjustments to the supplies inventory during the year. Much like accrued revenue, an accrued expense reflects a transaction where the actual payment is made after the good or service has been fully provided. WebAccrued revenue refers to goods or services you provided to the customer, but for which you have not yet received payment. Accrued expenses are defined as the expenses which are recognised in the books of accounts before they are actually paid. In the case of a prepayment, a company's goods or services will be delivered or performed in a future period. They are the expenses that a company has incurred but not yet paid to the service provider. WebA manager can overstate income and understate liabilities by treating deferred revenue as earned revenue. In this case, a company may provide services or deliver goods, but does so on credit. I feel like its a lifeline. Instead, they commonly ignore any accrued revenue while tracking deferred revenue the same as any other payment. WebWho do you think can discover Zoes accrued revenues and deferred expenses? Accrued expenses are defined as the expenses which are recognised in the books of accounts before they are actually paid. In the coming year, EC3: Russell Company is a pesticide manufacturer. It includes that portion of the revenue of a company that has not been earned yet, but the customers have already made the prepayment for the same. This type of expense represents an asset, because the money has already been spent and there will be a benefit to the company in the future. Contra Account | Contra Revenue Account Examples, Ledgers & Charts of Accounts | Concepts, Uses & Types, Accounts Payable | Journal Entry, Flow Chart & Invoice Processing. Most of the time, accountants will list this revenue with accounts receivable on their balance sheet at the time of the transaction. All rights reserved. As soon as the product or service is delivered or performed, then the deferred revenue becomes an earned revenue, and it moves from a companys balance sheet to their income statement. Tracking accrued revenue is also necessary to comply with GAAP standards, particularly the revenue recognition principle and the matching principle. Conversely, were this income only recorded when the funds had been received, the organization's revenue and profit would be reported in a less consistent manner, making it much more difficult to properly assess the overall health and financial standing of the business. Some common examples of deferred revenue that we see day to day include: When an e-commerce company receives an online payment for goods that they will later send to the customer in the post, When an insurance company receives a premium for the next 12 months of protection, When a contractor accepts a portion of the cost of the job upfront and defers the remaining balance until the project has been completed, A subscription box company receives advance payment for a years subscription, but no boxes have yet been sent out to the subscriber. She has experience teaching math to middle school students as well as teaching accounting at the college level. Most of the time, accountants will list this revenue with accounts receivable on their balance sheet at the time of the transaction. succeed. Deferring them takes them out of expenses and creates an asset on the balance sheet. WebWho can discover Zoes accrued revenue and deferred expenses? Accrued Expense. Evan Tarver has 6+ years of experience in financial analysis and 5+ years as an author, editor, and copywriter. But the exchange of products and services with money isnt always as simultaneous as wed like it to be. Deferred income is recorded as a short-term liability in the balance sheet of a business. 138 lessons Assuming that all revenue is liquid cash can be a dangerous habit to get into, especially when less than satisfied customers start asking for refunds. Properly understanding both accrued and deferred revenue is critical to properly understanding your business. In the. It allows them to manage their finances adequately.